Medium-term Management Plan

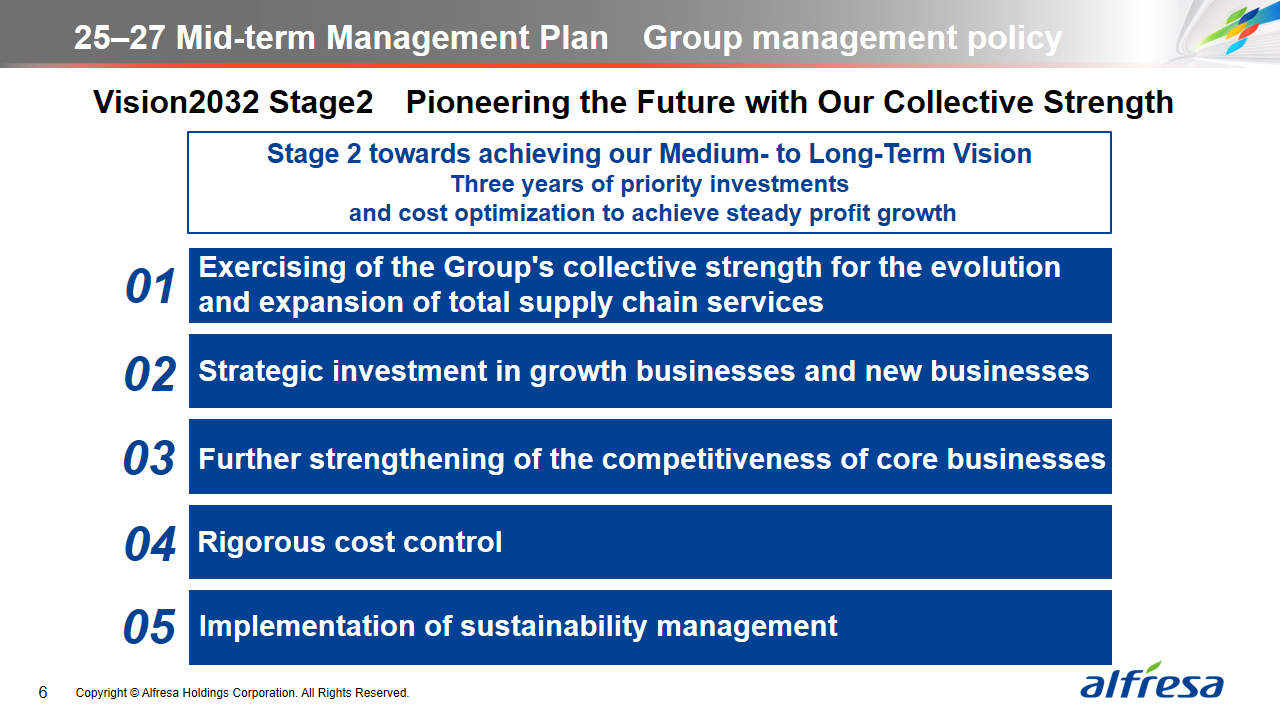

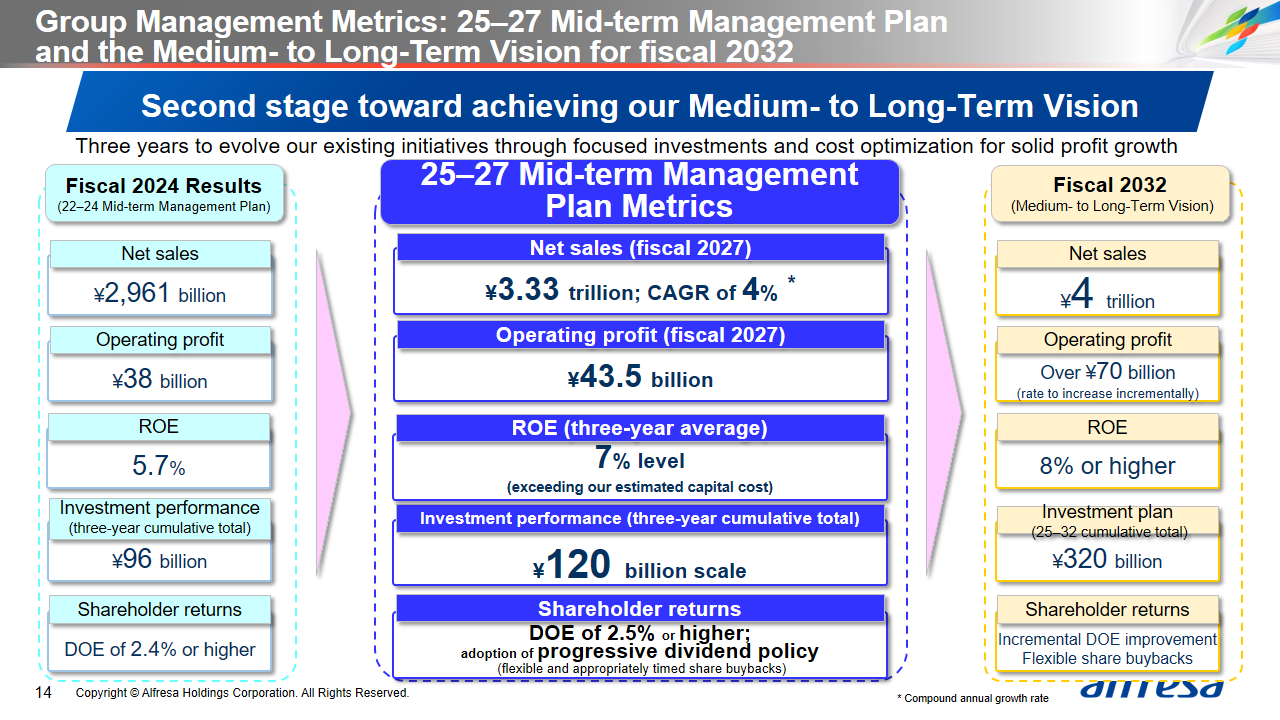

25-27 Mid-term Management Plan Vision2032 Stage2

"Pioneering the Future with Our Collective Strength"

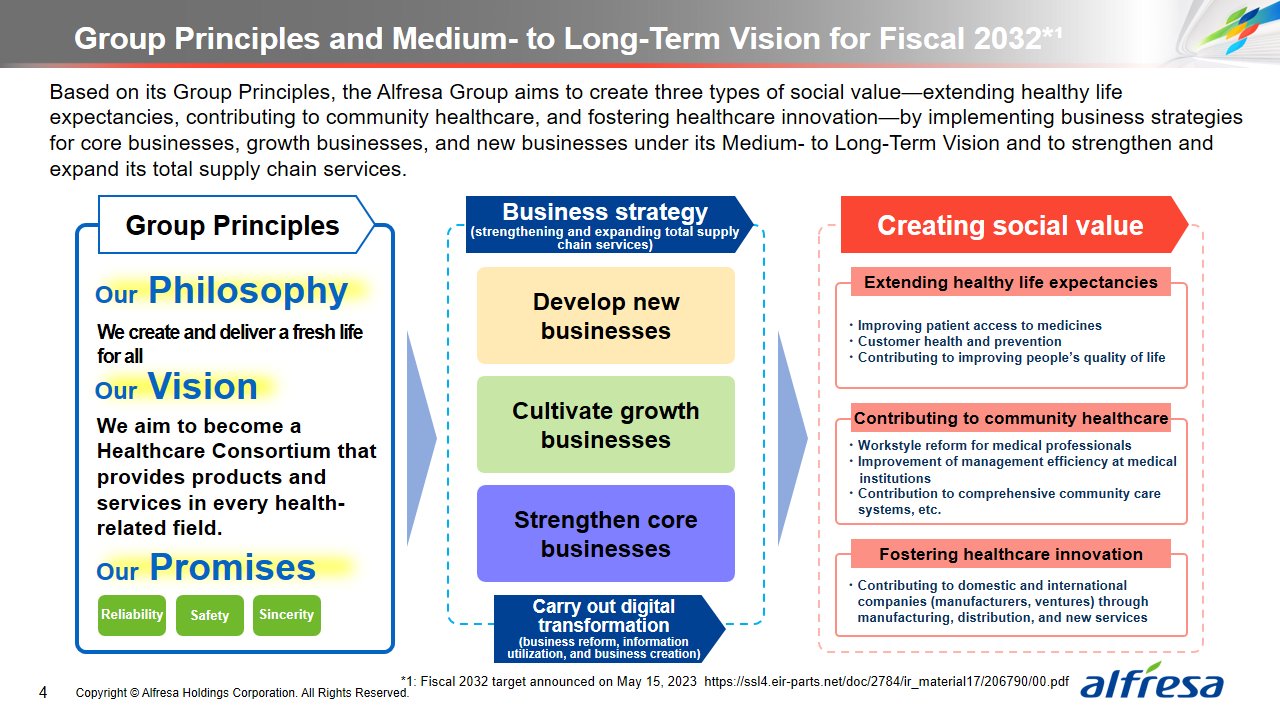

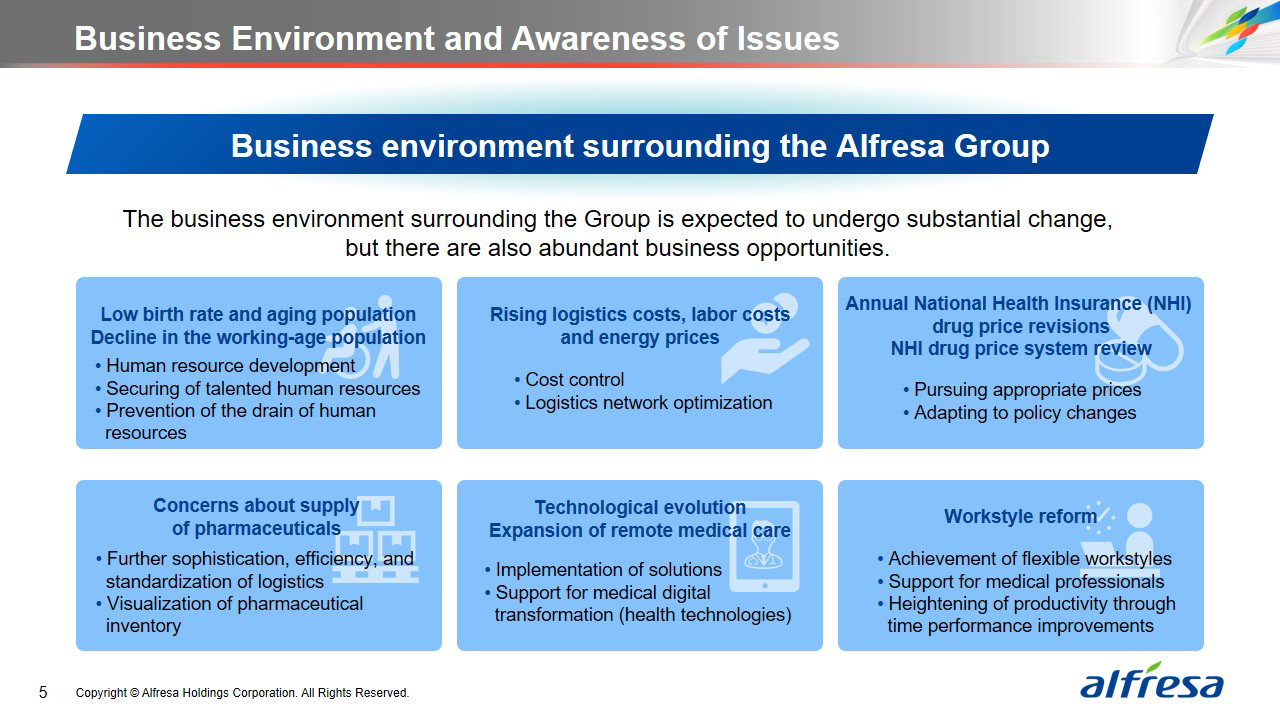

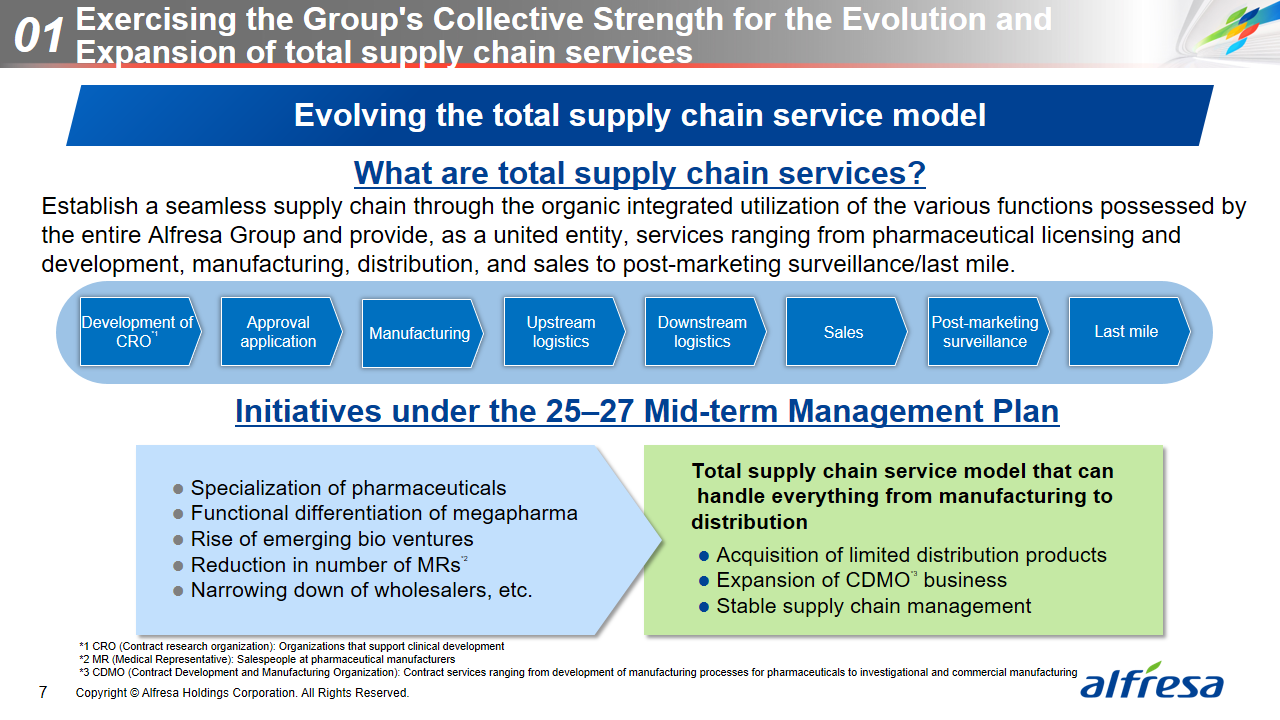

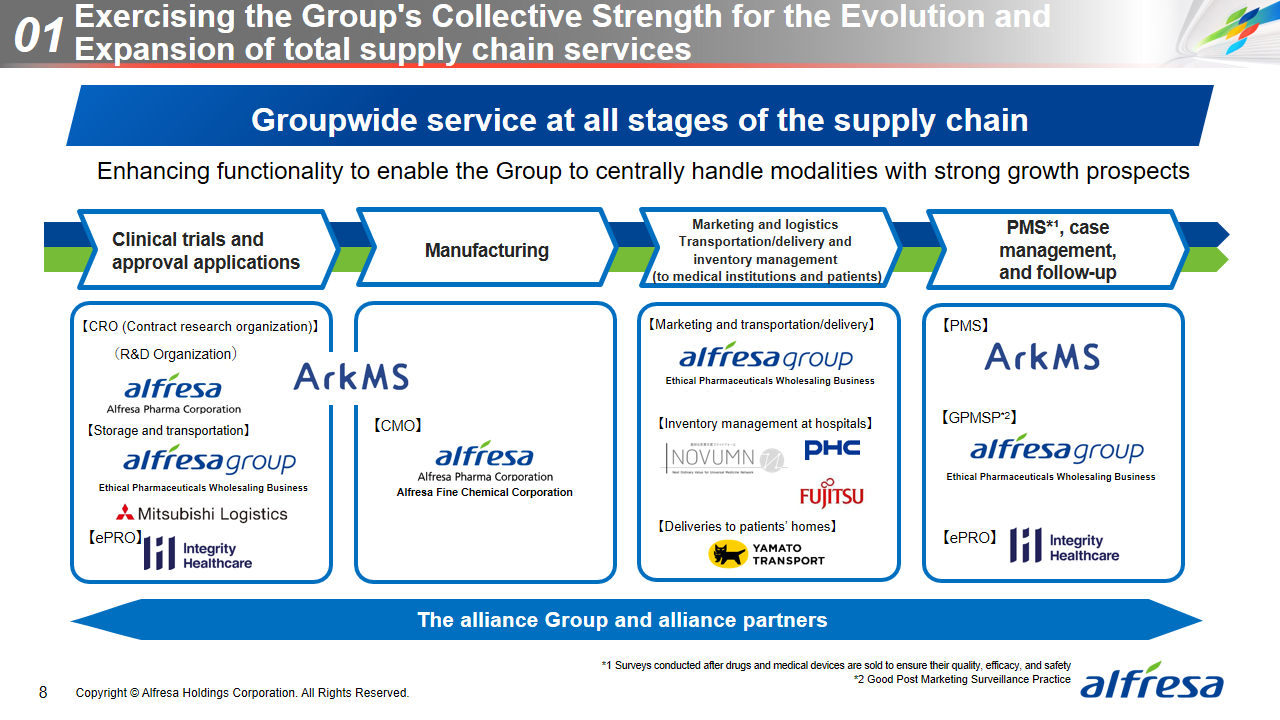

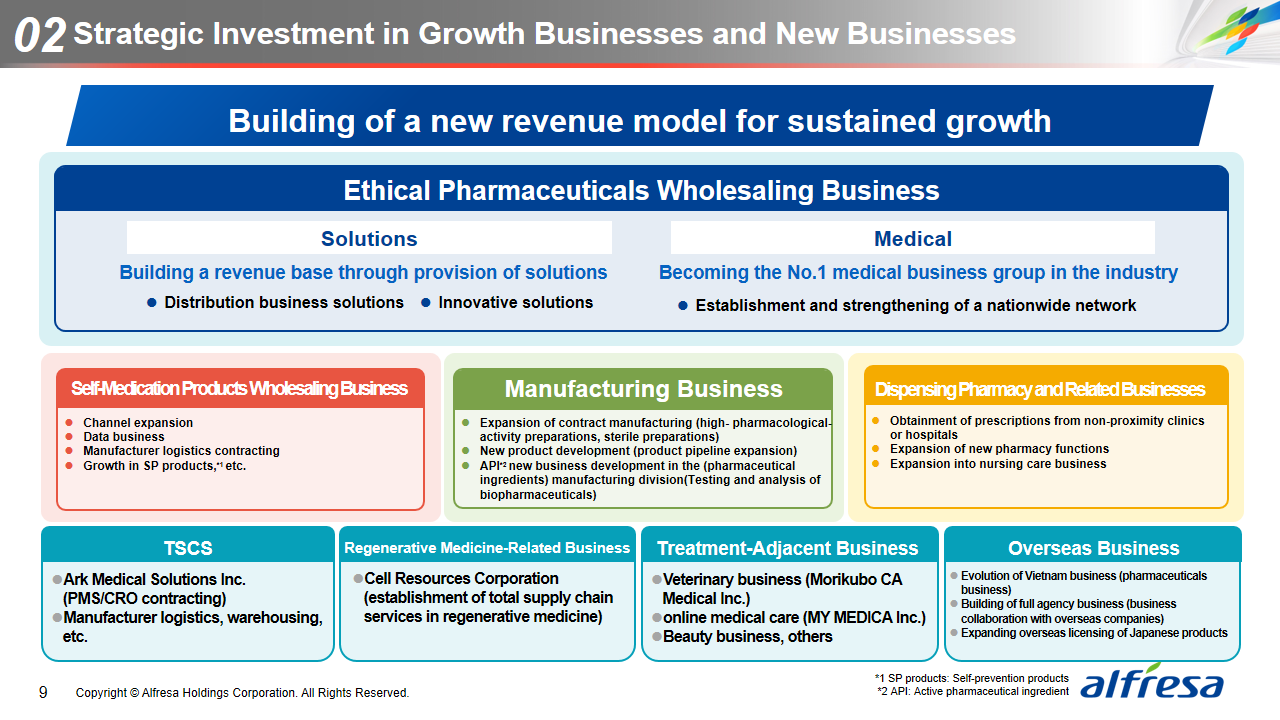

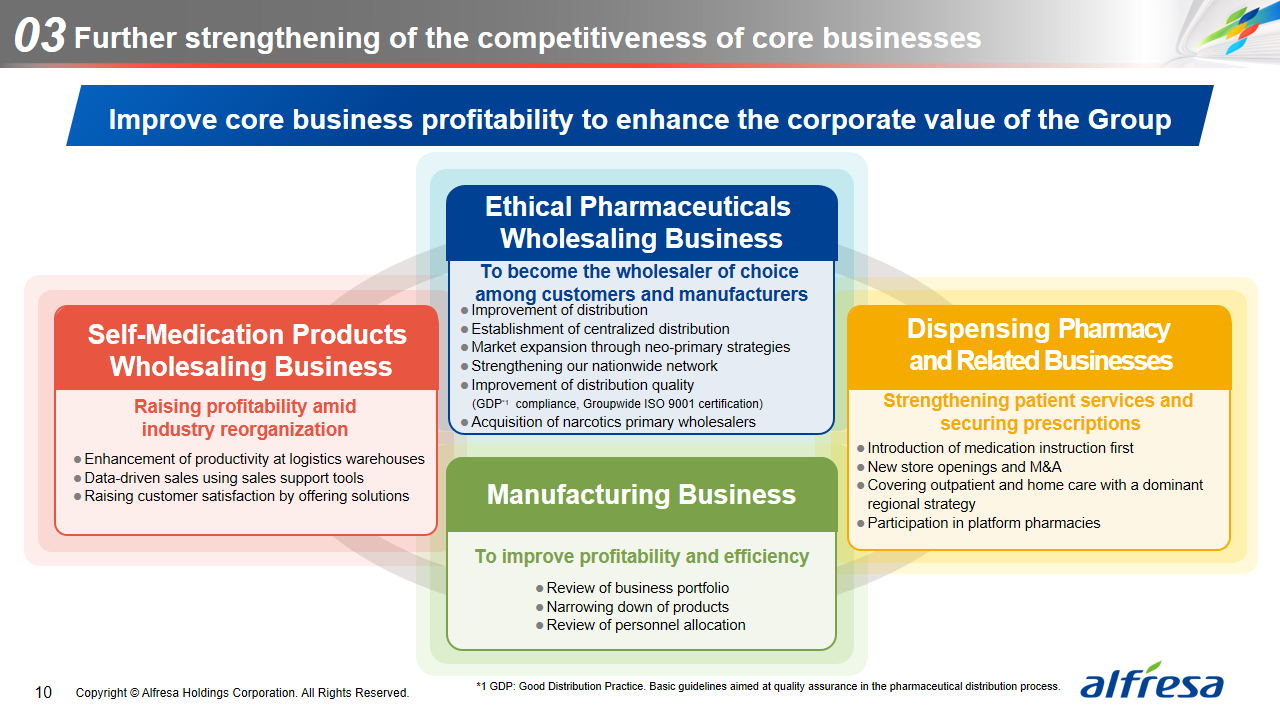

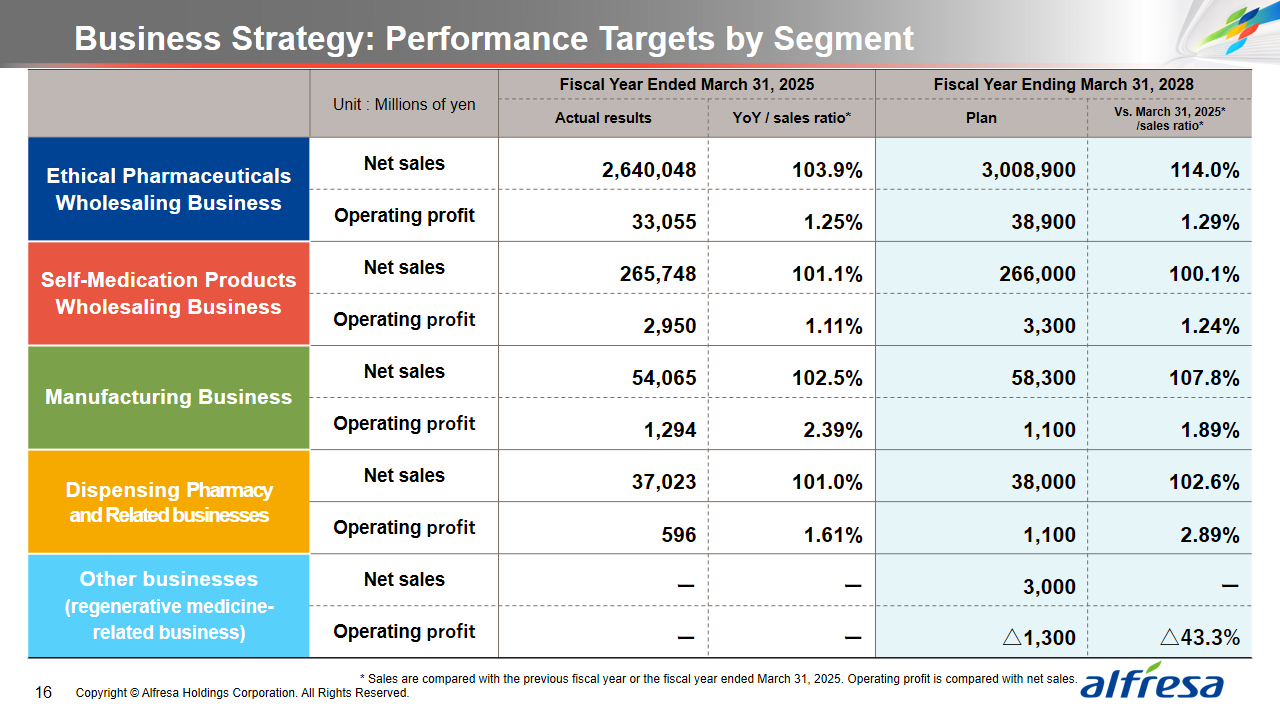

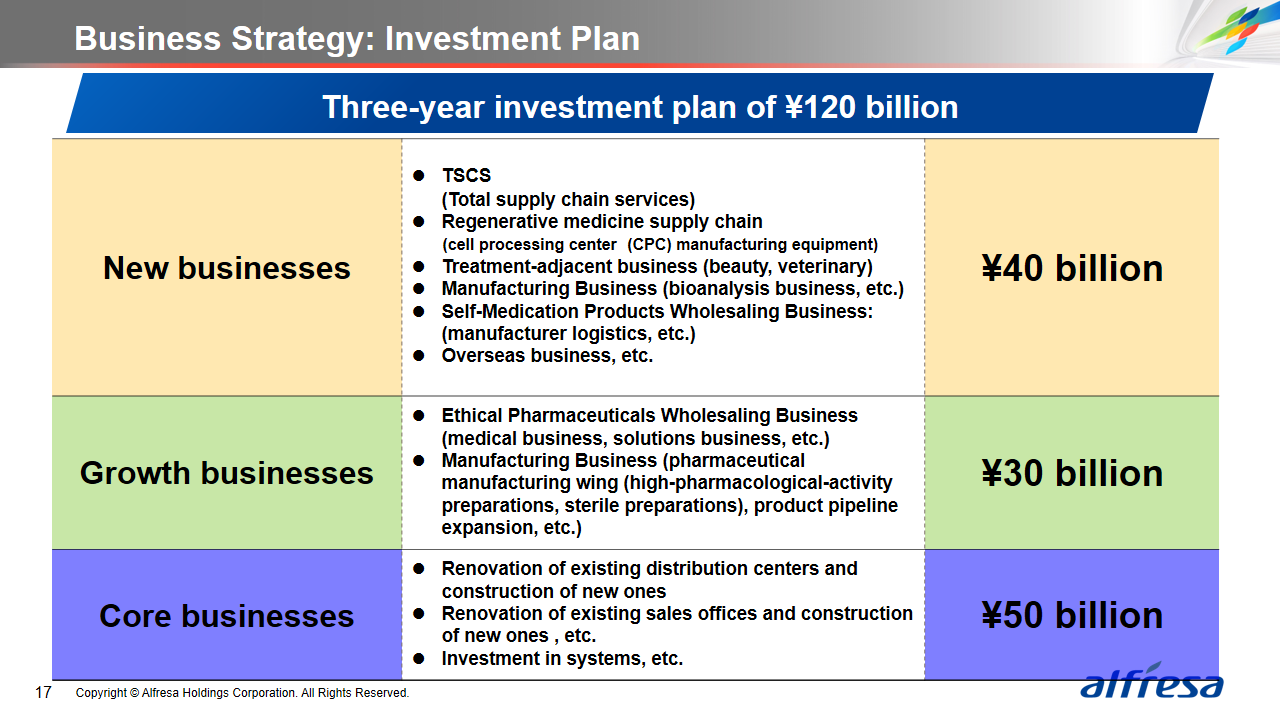

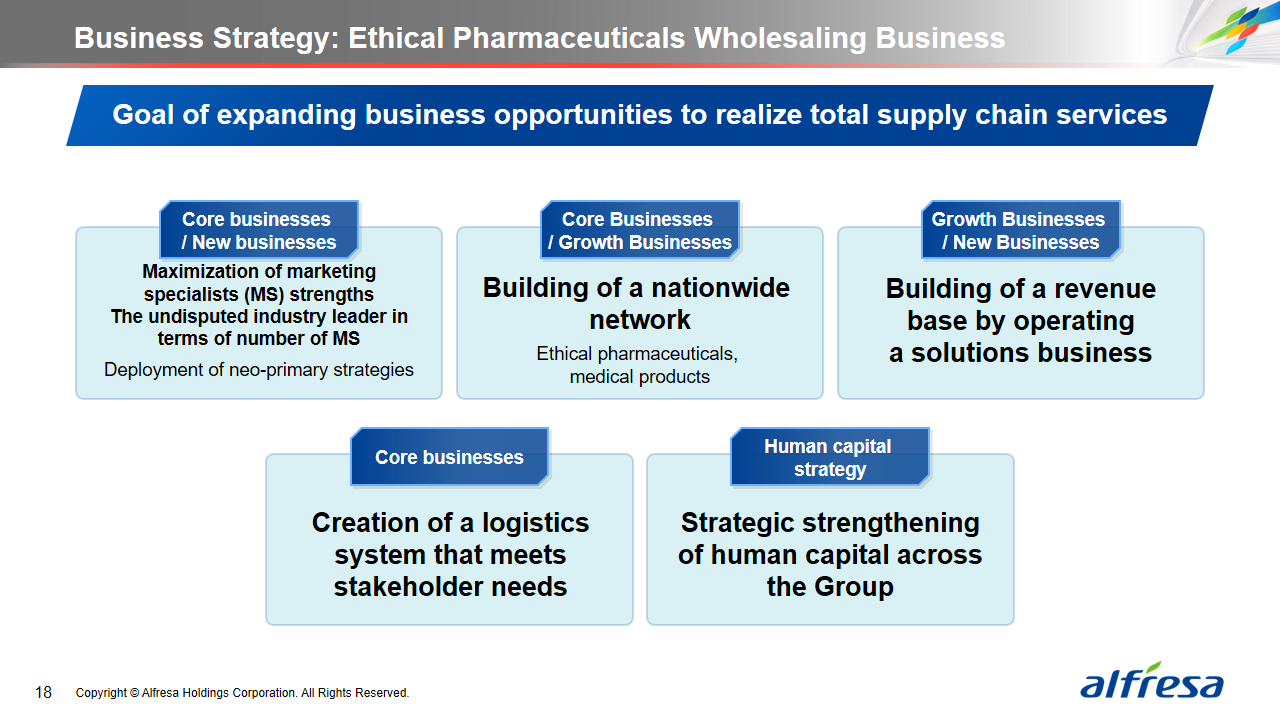

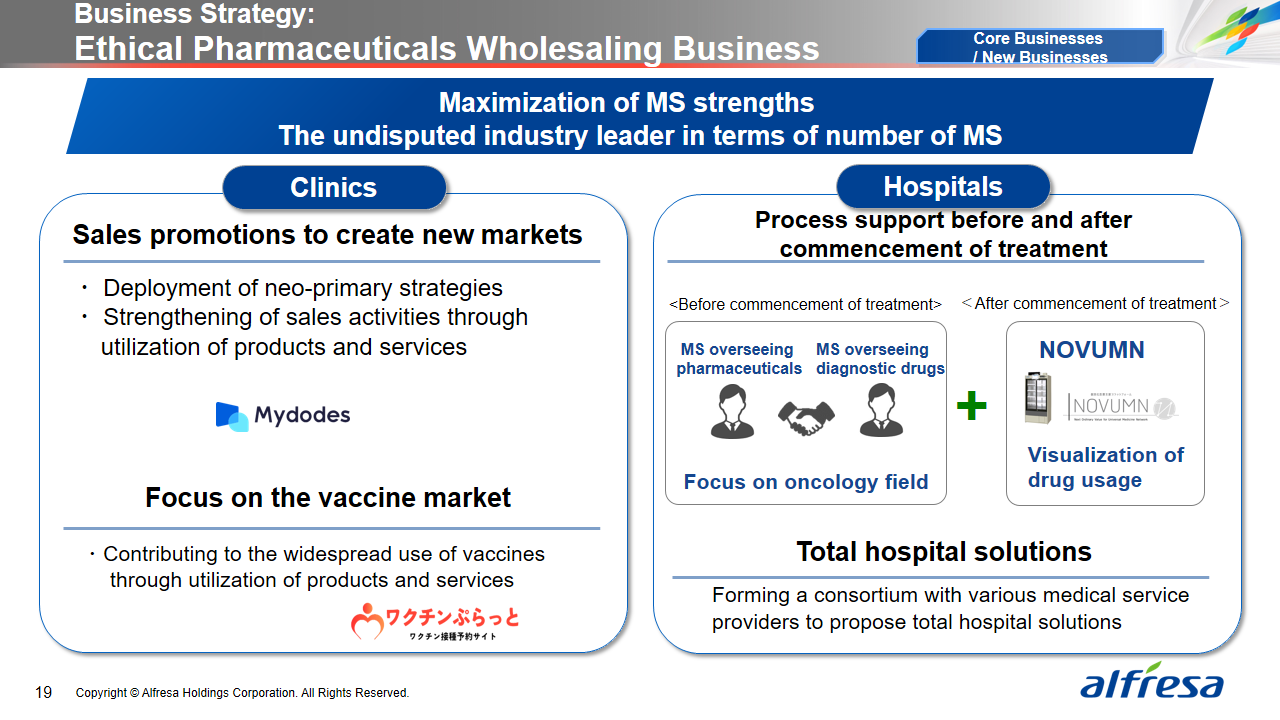

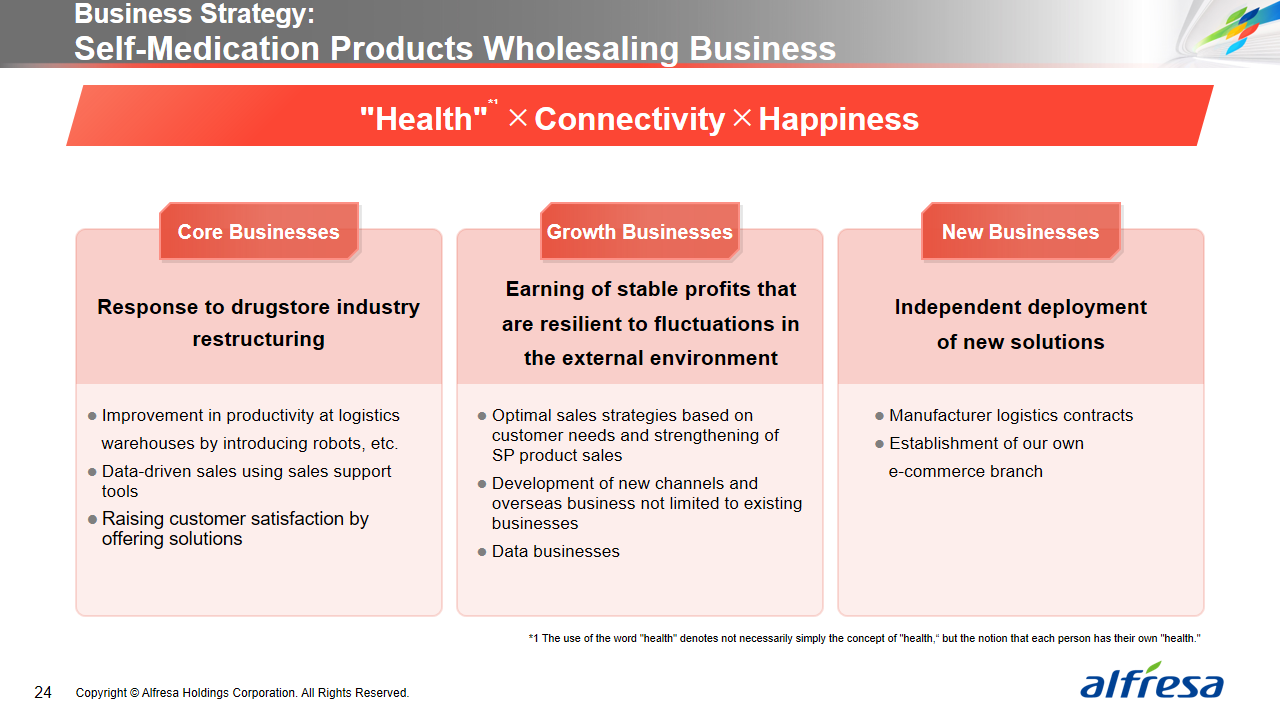

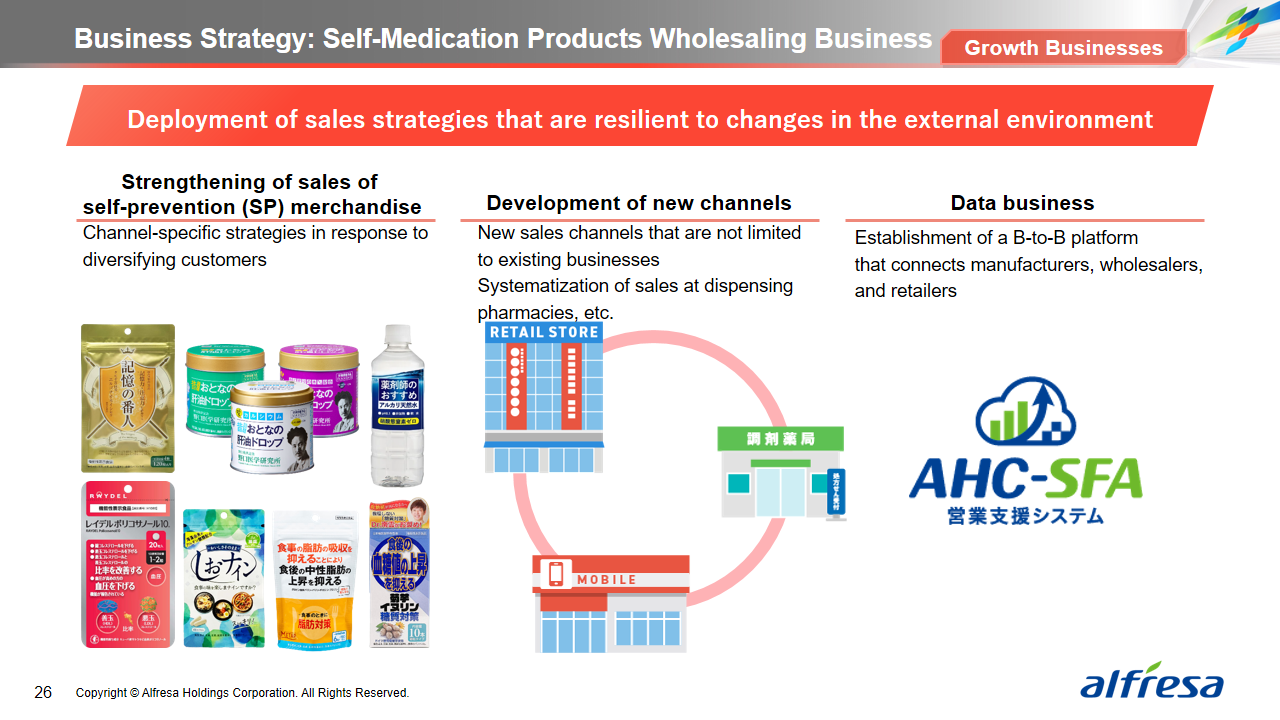

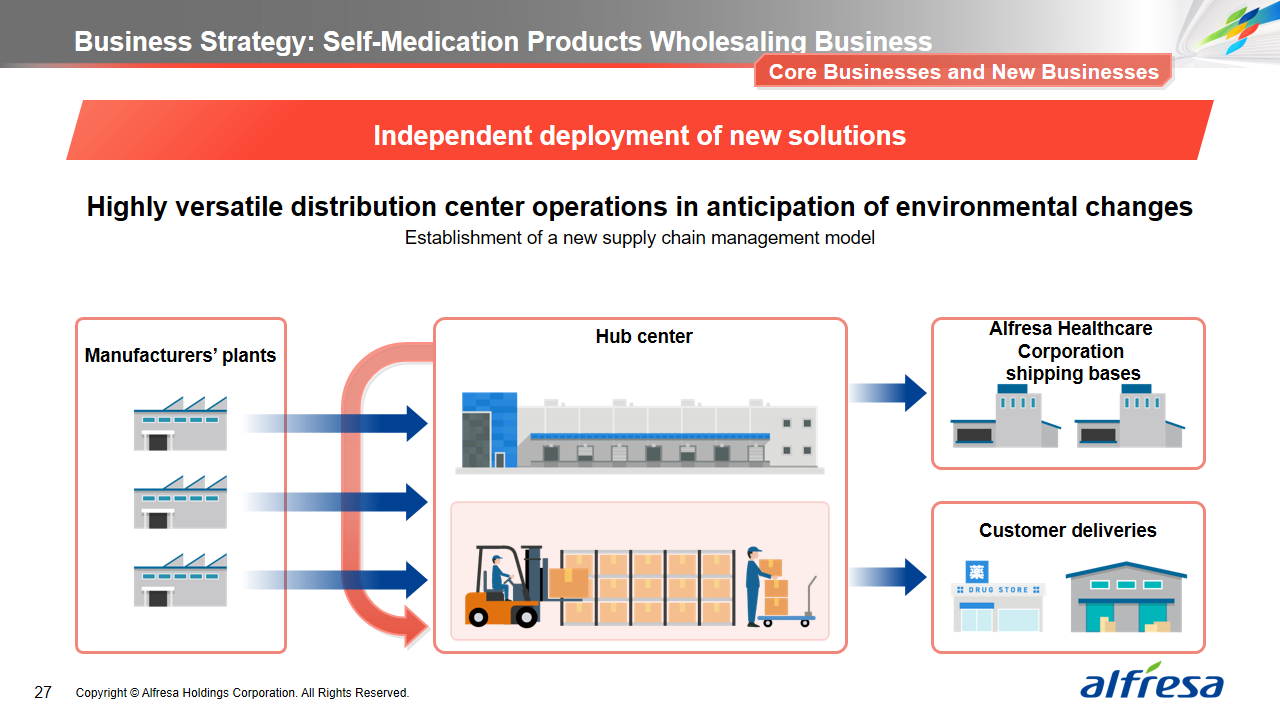

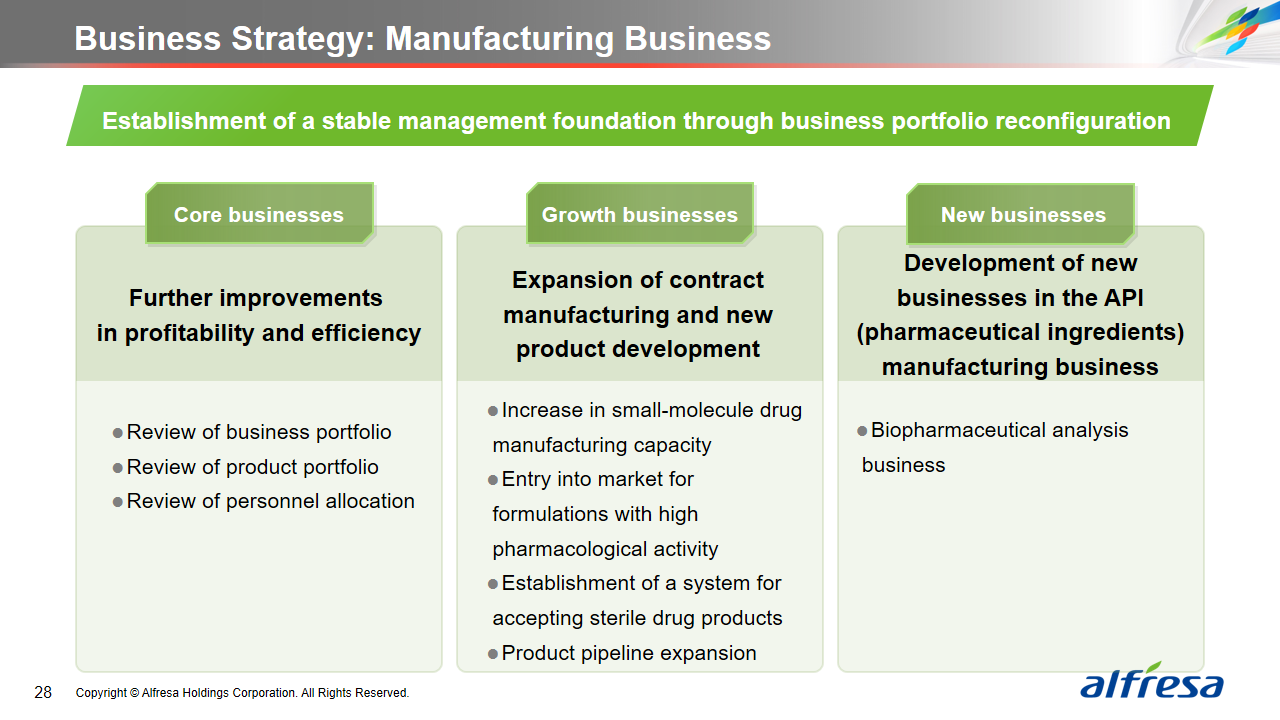

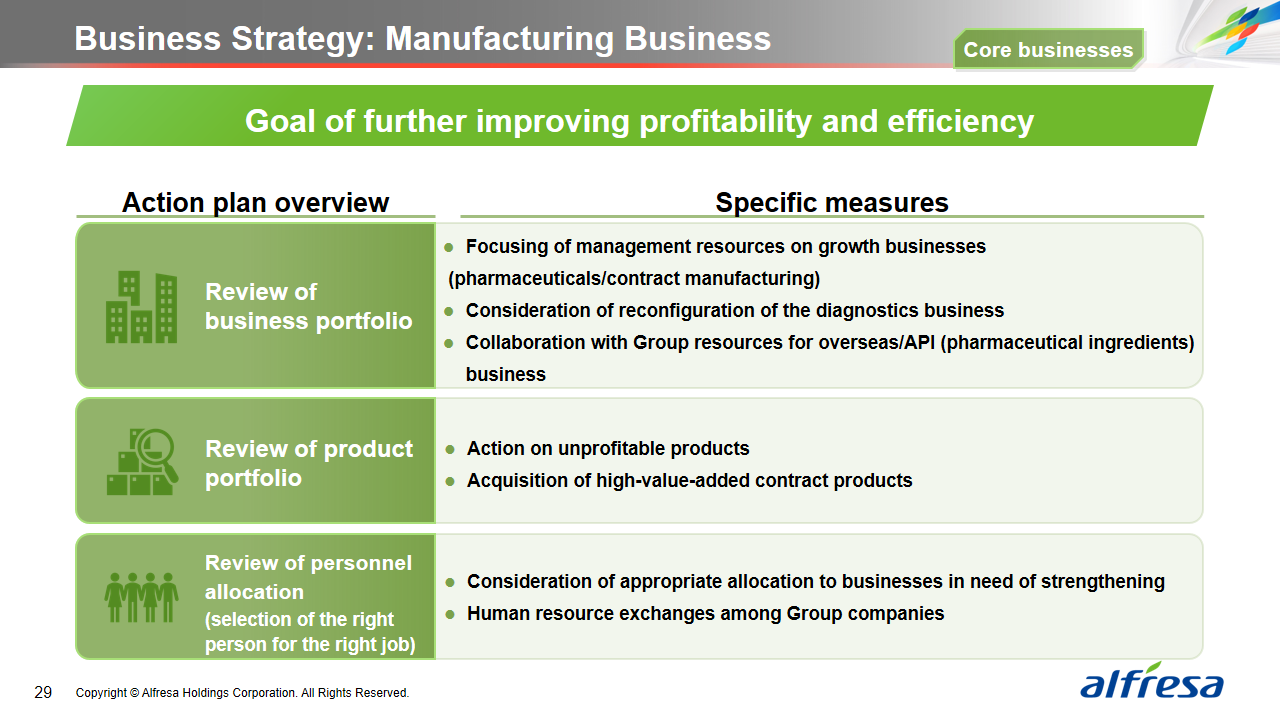

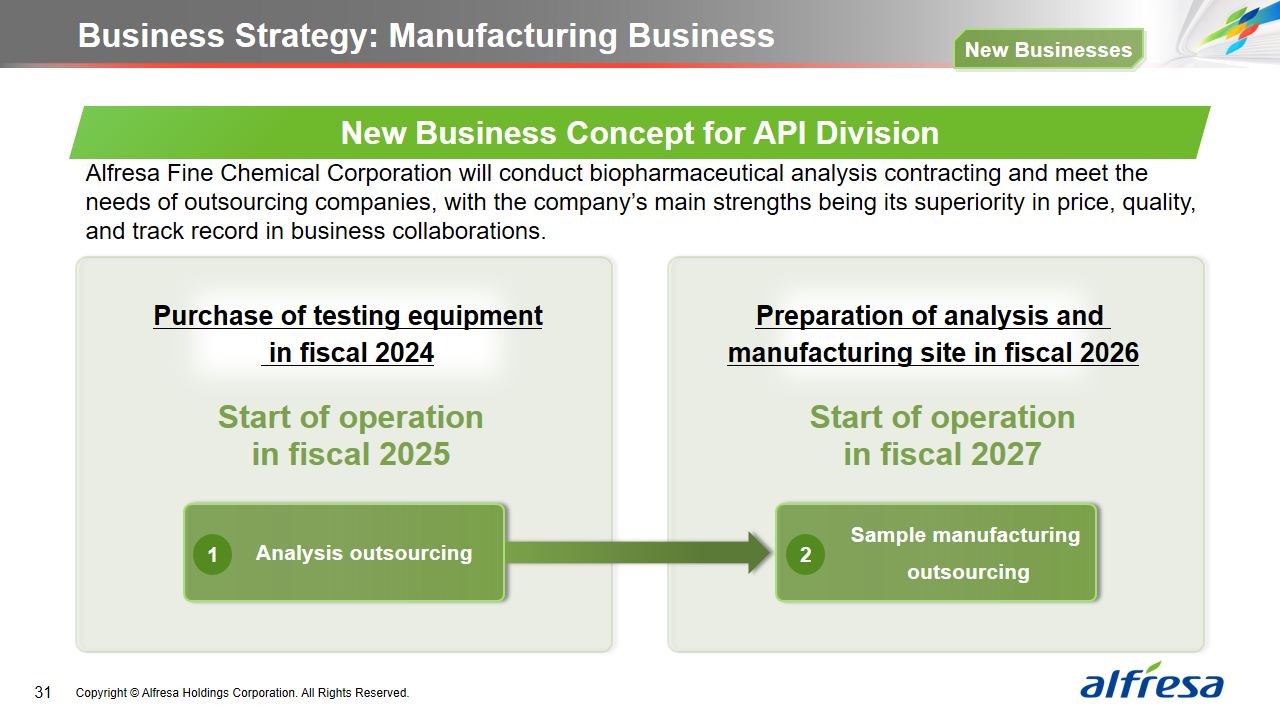

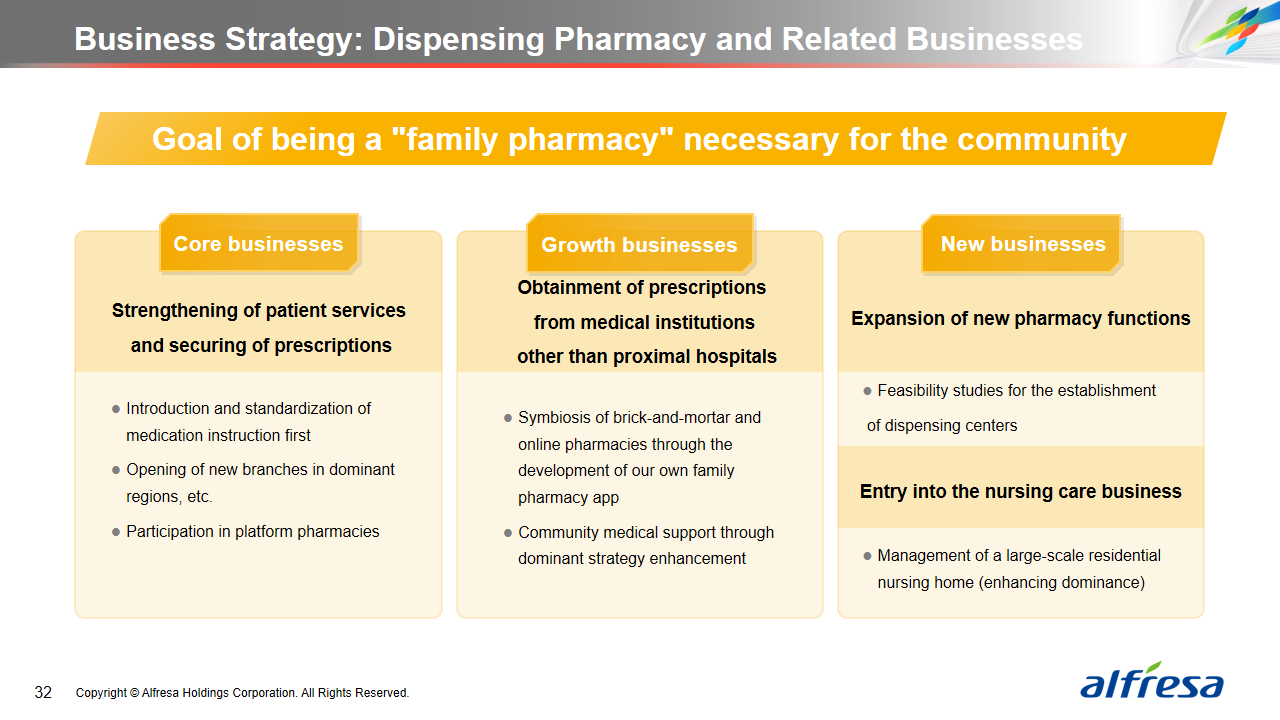

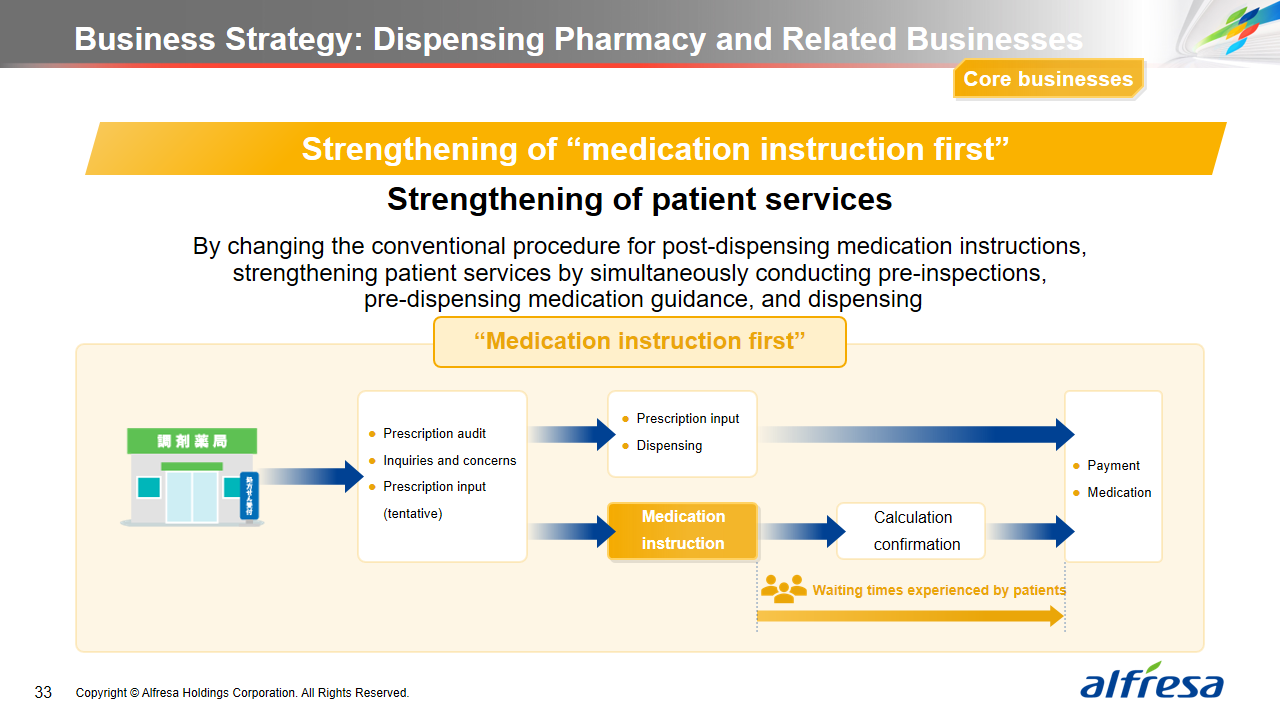

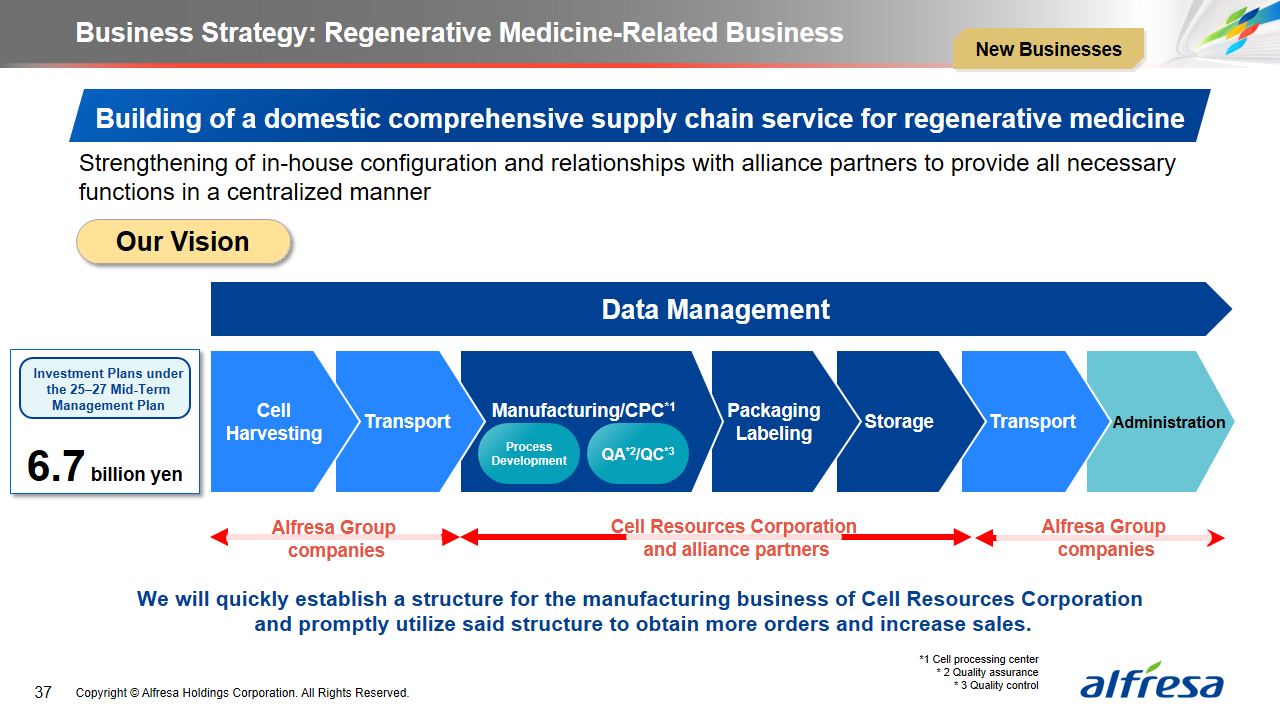

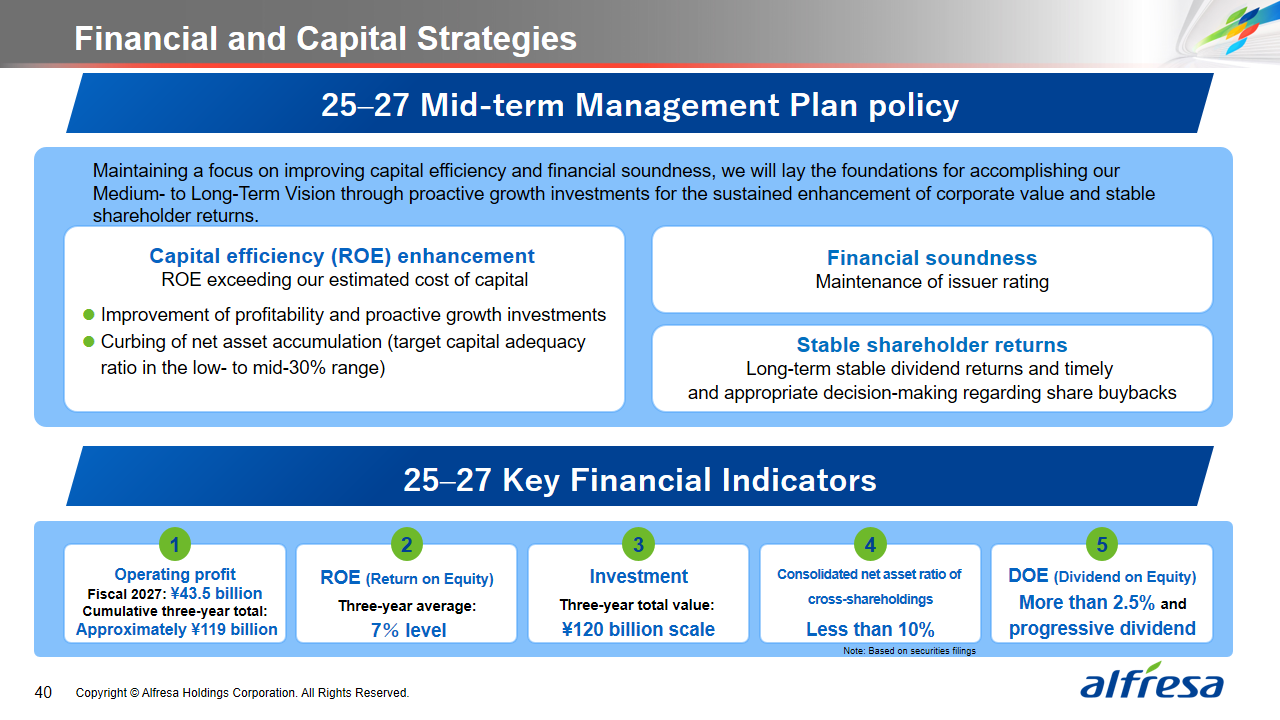

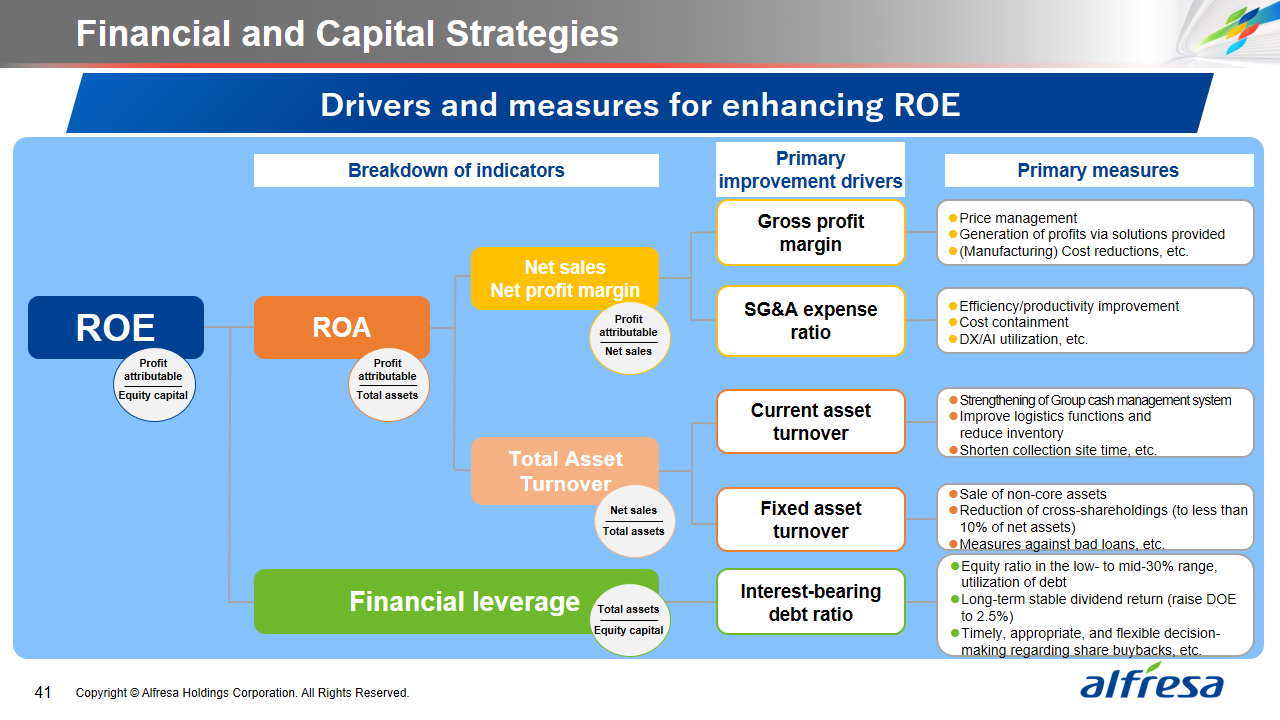

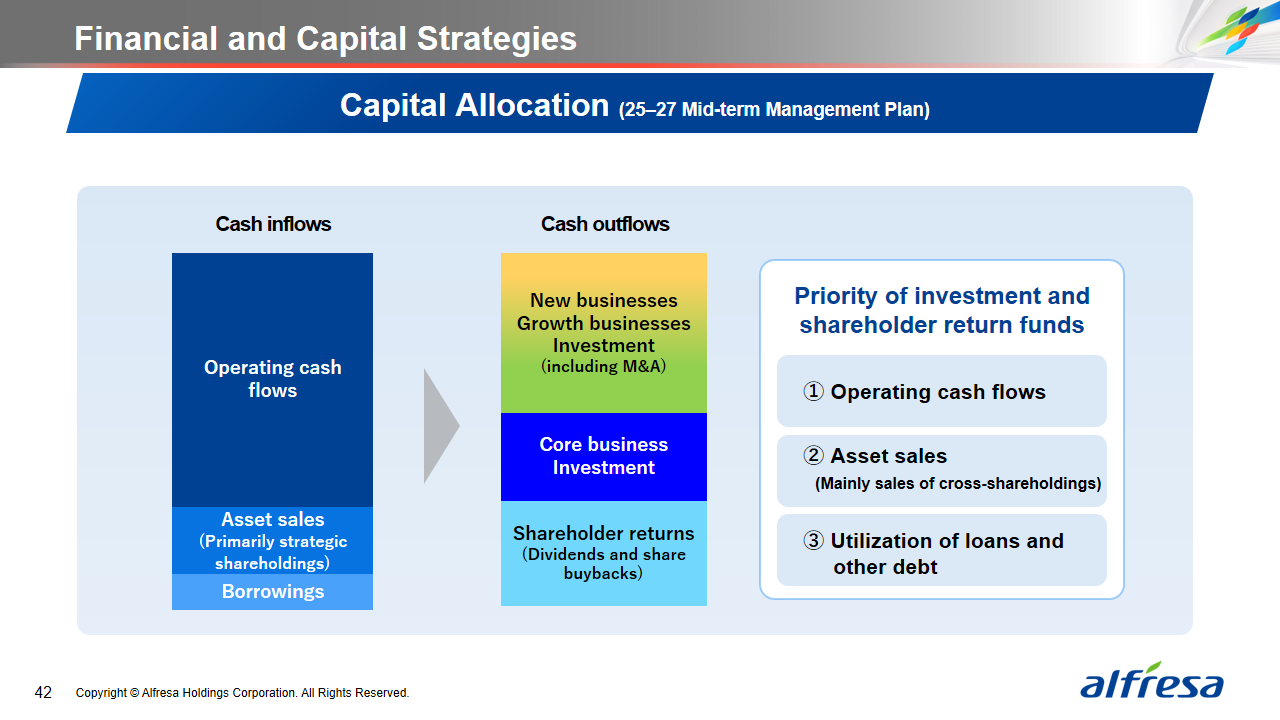

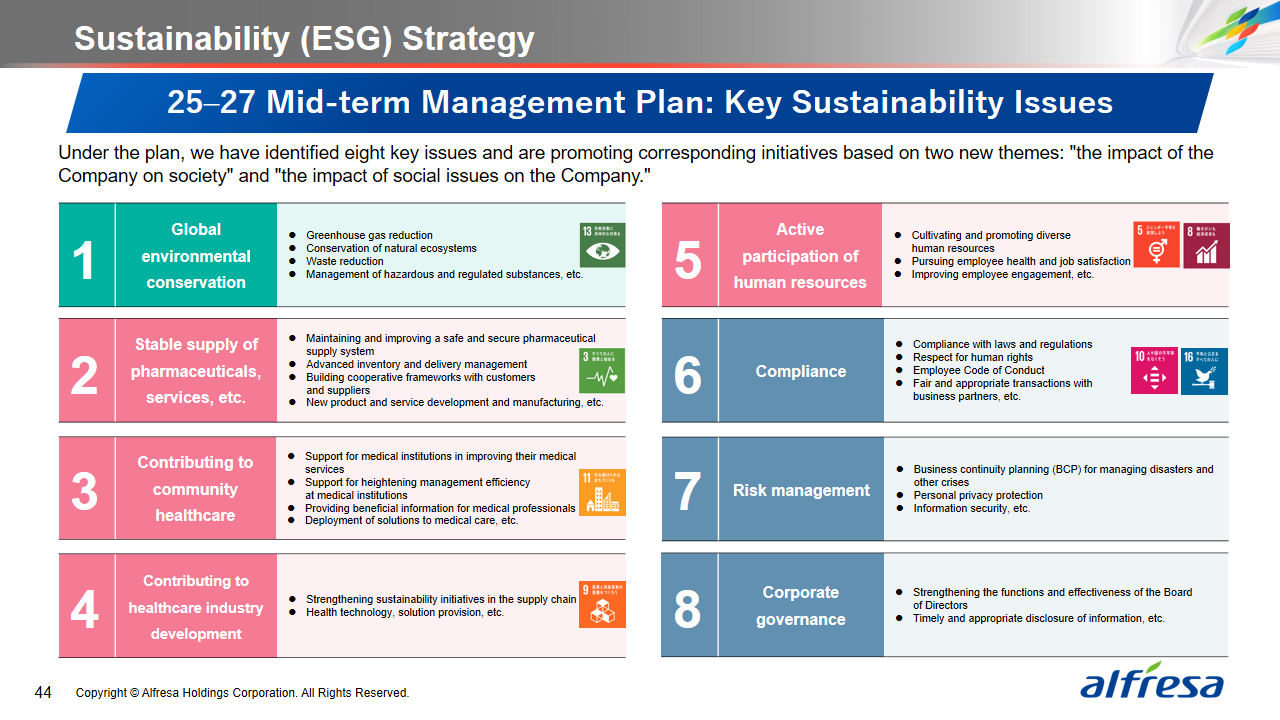

In accordance with the Alfresa Group's Medium- to Long-Term Vision*1 (hereinafter referred to as the "Medium- to Long-Term Vision"), which was formulated in 2023 and comprises the Group's medium- to long-term business strategy and financial and capital strategies up to the fiscal year ending March 31, 2033, and in accordance with the Group Management Policy, the Group aims to create social value by extending healthy life expectancies, contributing to community healthcare, and fostering healthcare innovation through the implementation of business strategies that strengthen core businesses, cultivate growth businesses, and develop new businesses and through the strengthening and expansion of total supply chain services*2 (hereinafter referred to as the "TSCSs"). Based on the newly formulated 25–27 Mid-term Management Plan, which is the second stage of initiatives aimed at achieving the goals of the Medium- to Long-Term Vision, the Group will evolve existing initiatives and steadily increase profits by executing targeted investments and optimizing costs.

*1Reference: "Notice regarding the Formulation of the Alfresa Group's Medium- to Long-Term Vision," announced on May 15, 2023

*2TSCSs refer to the organic, integrated utilization of the various functions possessed by the Alfresa Group to enable the establishment of a seamless supply chain and the Group's unified provision of services in areas extending from the introduction, development, and manufacture of pharmaceuticals and other products through to their distribution, sales, and post-marketing surveillance.

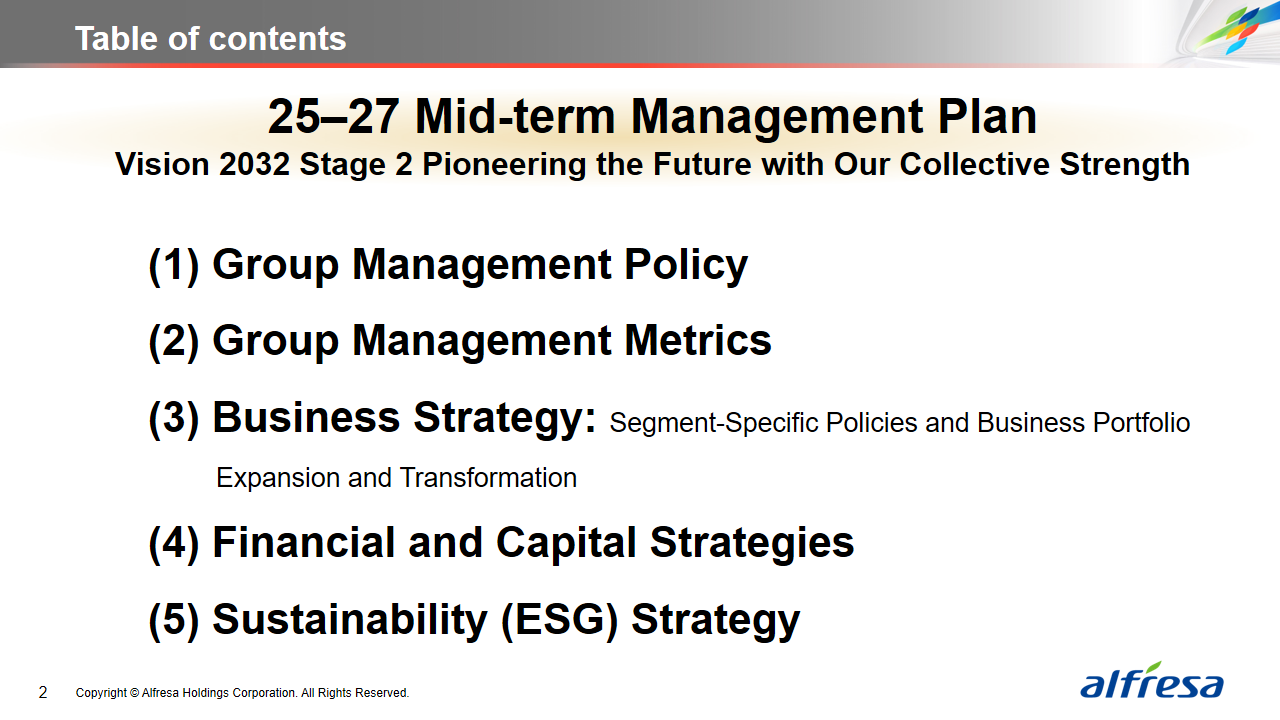

Contents